The Best Strategy To Use For Pacific Prime

The Best Strategy To Use For Pacific Prime

Blog Article

The Pacific Prime Ideas

Table of ContentsRumored Buzz on Pacific PrimePacific Prime Things To Know Before You Get ThisThe Of Pacific PrimeThe 3-Minute Rule for Pacific PrimeThe Main Principles Of Pacific Prime

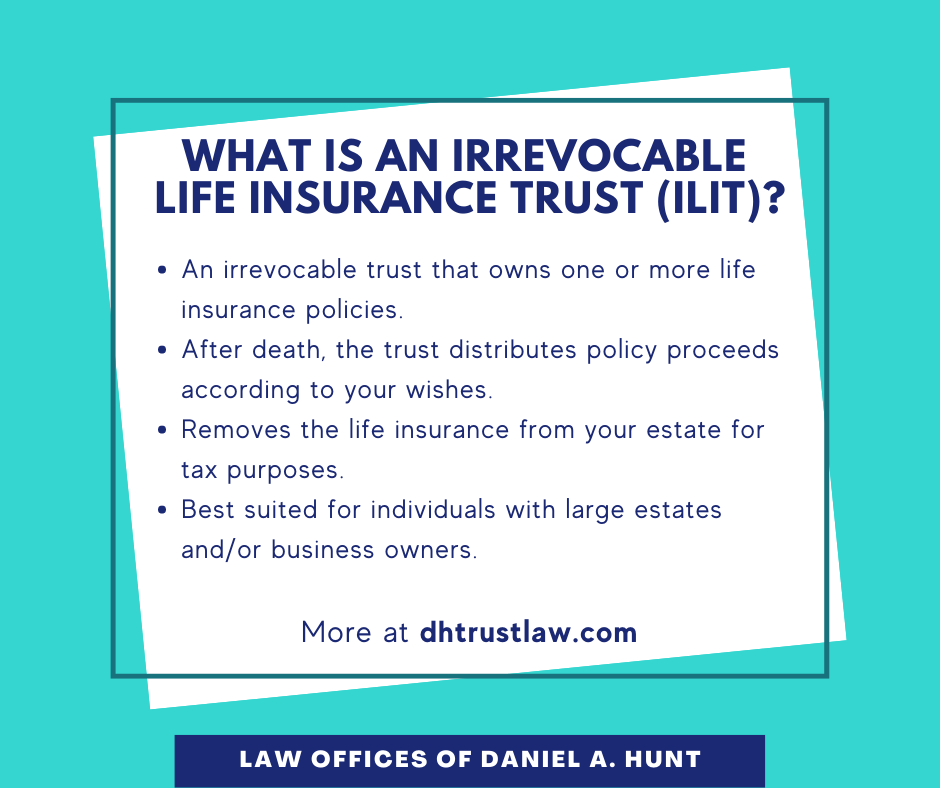

Insurance is an agreement, stood for by a policy, in which a policyholder gets financial protection or compensation versus losses from an insurance company. A lot of people have some insurance coverage: for their automobile, their residence, their health care, or their life.Insurance policy additionally helps cover expenses connected with responsibility (lawful duty) for damages or injury caused to a 3rd party. Insurance coverage is an agreement (policy) in which an insurance company indemnifies another versus losses from particular contingencies or dangers. There are numerous sorts of insurance coverage. Life, wellness, homeowners, and car are amongst the most common forms of insurance.

Investopedia/ Daniel Fishel Lots of insurance plan types are readily available, and virtually any type of private or service can discover an insurance coverage business prepared to guarantee themfor a rate. A lot of people in the United States have at least one of these types of insurance coverage, and vehicle insurance is needed by state legislation.

Get This Report on Pacific Prime

Discovering the rate that is best for you requires some legwork. The policy limit is the maximum amount an insurer will pay for a covered loss under a policy. Optimums might be set per duration (e.g., yearly or plan term), per loss or injury, or over the life of the plan, additionally called the lifetime optimum.

There are several different types of insurance policy. Health and wellness insurance coverage helps covers routine and emergency medical care expenses, frequently with the alternative to add vision and oral services independently.

Lots of preventative solutions might be covered for cost-free before these are fulfilled. Health and wellness insurance may be bought from an insurance firm, an insurance representative, the government Health Insurance policy Marketplace, offered by an employer, or government Medicare and Medicaid protection.

Not known Details About Pacific Prime

The company then pays all or many of the covered costs linked with a vehicle mishap or various other automobile damages. If you have a leased automobile or borrowed money to get a car, your loan provider or renting car dealership will likely require you to bring vehicle insurance coverage.

A life insurance plan warranties that the insurer pays a sum of cash to your recipients (such as a partner or youngsters) if you die. There are 2 main types of life insurance.

Insurance policy is a way to manage your economic threats. When you purchase insurance, you buy security versus unexpected monetary losses. The insurer pays you or someone you pick if something poor takes place. If you have no insurance and a mishap occurs, you might be accountable for all relevant expenses.

Some Ideas on Pacific Prime You Should Know

There are many insurance plan types, some of the most typical are life, health and wellness, home owners, and car. The right type of insurance policy for you will certainly depend upon your goals and financial scenario.

Have you ever before had a moment while looking at your insurance coverage plan or buying for insurance when you've believed, "What is insurance policy? Insurance policy can be a mystical and puzzling point. Exactly how does insurance coverage job?

Experiencing a loss without insurance policy can put you in a difficult economic scenario. Insurance policy is an essential monetary tool.

A Biased View of Pacific Prime

And in many cases, like vehicle insurance policy and employees' payment, you may be needed by law to have insurance coverage in order to shield others - maternity insurance for expats. Learn more about ourInsurance alternatives Insurance coverage is essentially a gigantic nest egg shared by lots of people (called policyholders) and taken care of by an insurance policy copyright. The insurance company utilizes cash collected (called costs) from its insurance policy holders and other financial investments to pay for its procedures and to meet its assurance to policyholders when they sue

Report this page